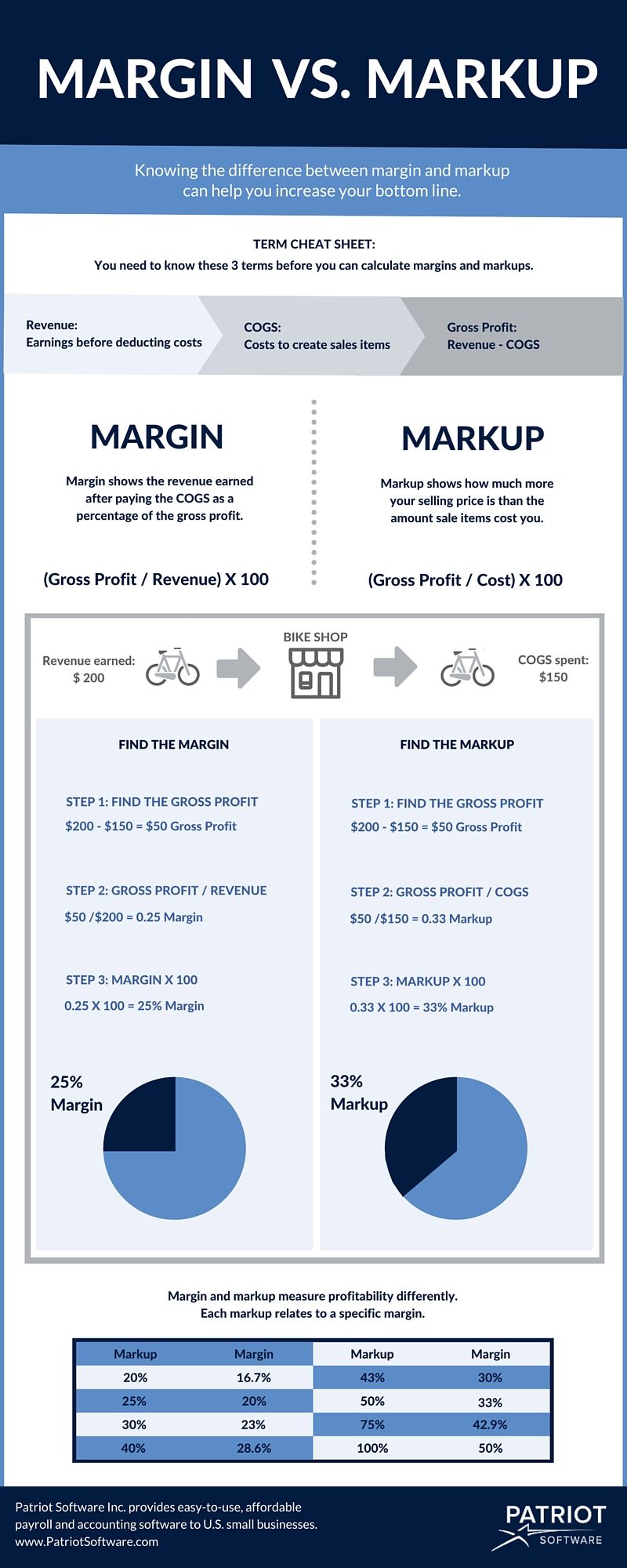

How To Calculate Margin Vs Markup. So, how you calculate your margin is you take your total revenue, minus total expenses, and that will equal your profit. Using the same cost, $5.00, and selling price, $10.00 as above, the markup would be 100% because you are marking up the cost of the product by 100%.

Using the same cost, $5.00, and selling price, $10.00 as above, the markup would be 100% because you are marking up the cost of the product by 100%. The profit margin, stated as a percentage, is 30% (calculated as the margin divided by sales). Income you earn by selling your products and services.revenue is the top line of your p&l (profit and loss) statement and reflects earnings before deductions.

Desired margin ÷ cost of goods = markup percentage.

To change over the margin into markup, use the following formula: Click “calculate”, and the procedure is over. To convert margin to markup, use this formula: Use the formulas below to convert your numbers and get a better understanding of your pricing.

Knowing the difference between margin and markup is critical. This can be done using formulas or a calculator. For recruiters, a tremendous amount of work goes into making a placement. How to calculate your markup and your margin.

0.4 * 100 = 40%. Desired margin ÷ cost of goods = markup percentage. Before you can calculate your margins and markups, you need to get to grips with these terms: To help, use this simple margin vs markup chart:

The profit margin, stated as a percentage, is 30% (calculated as the margin divided by sales). Then you take your profit, you divide into your total revenue, and that will give you a percentage. But there’s a lot more to know about markups and margin. The markup rate is 25%.

This means you can use one to determine the other.

To derive other markup percentages, the calculation is: Click “calculate”, and the procedure is over. Suppose you need a 30% margin and need to realise how much your markup ought to be. For recruiters, a tremendous amount of work goes into making a placement.

Margin, you need to understand the following three terms: Or, you can enter the cost and the selling price of an item to determine the markup. You will markup and margin values. Knowing the difference between margin and markup is critical.

As in the margin example you can enter the cost and desired markup for an item to get the selling price of an item. $20 / $50 = 0.4. Your calculations would look like this: Your revenue, minus your cogs.

That said, your net profit margin reflects the overall success of your strategy. The markup rate is 25%. Your calculations would look like this: So, always figure out your margin first, before you do your markup.

Use the formulas below to convert your numbers and get a better understanding of your pricing.

You can calculate your markup using this. Before we dive into the difference between markup vs. How to convert margin to markup and vice versa margin to markup. Let’s use the same product to clarify the differences between markup and margin better.

Your revenue, minus your cogs. So, always figure out your margin first, before you do your markup. To calculate markup subtract your product cost from your selling price. You can calculate your markup using this.

This can be done using formulas or a calculator. Your revenue, minus your cogs. Each row represents a margin % from 1 to 99. So, how you calculate your margin is you take your total revenue, minus total expenses, and that will equal your profit.

So, always figure out your margin first, before you do your markup. As in the margin example you can enter the cost and desired markup for an item to get the selling price of an item. Your earnings before deducting costs. You will get the values in a few seconds.

So, how you calculate your margin is you take your total revenue, minus total expenses, and that will equal your profit.

The difference between the two is what will impact your business profits. This means you can use one to determine the other. Find out your revenue (how much you sell these goods for, for example $50 ). For example, if you know that the cost of a product is $7 and you want to earn a margin of $5 on it, the calculation of the markup percentage is:

You can calculate your markup using this. Or, you can enter the cost and the selling price of an item to determine the markup. Even though markup versus margin can be challenging to understand, the good news is that the formulas for calculating both are relatively simple. Yes, the method is much easy and quick.

For example, say chelsea sells a cup of coffee for $3.00, and between the cost of the beans, cups, and direct labor, it costs chelsea $0.50 to produce each cup. You can also use a markup vs margin table to easily see this relationship for the most common rates. For recruiters, a tremendous amount of work goes into making a placement. Margin vs markup in recruitment.

The difference between total business revenue and total business expenses. For example, say chelsea sells a cup of coffee for $3.00, and between the cost of the beans, cups, and direct labor, it costs chelsea $0.50 to produce each cup. $20 / $50 = 0.4. You will markup and margin values.