I love looking at these charts because they really squash some of the myths around investing and highlight the benefit of investing in index funds. Let’s break down some of the takeaways.

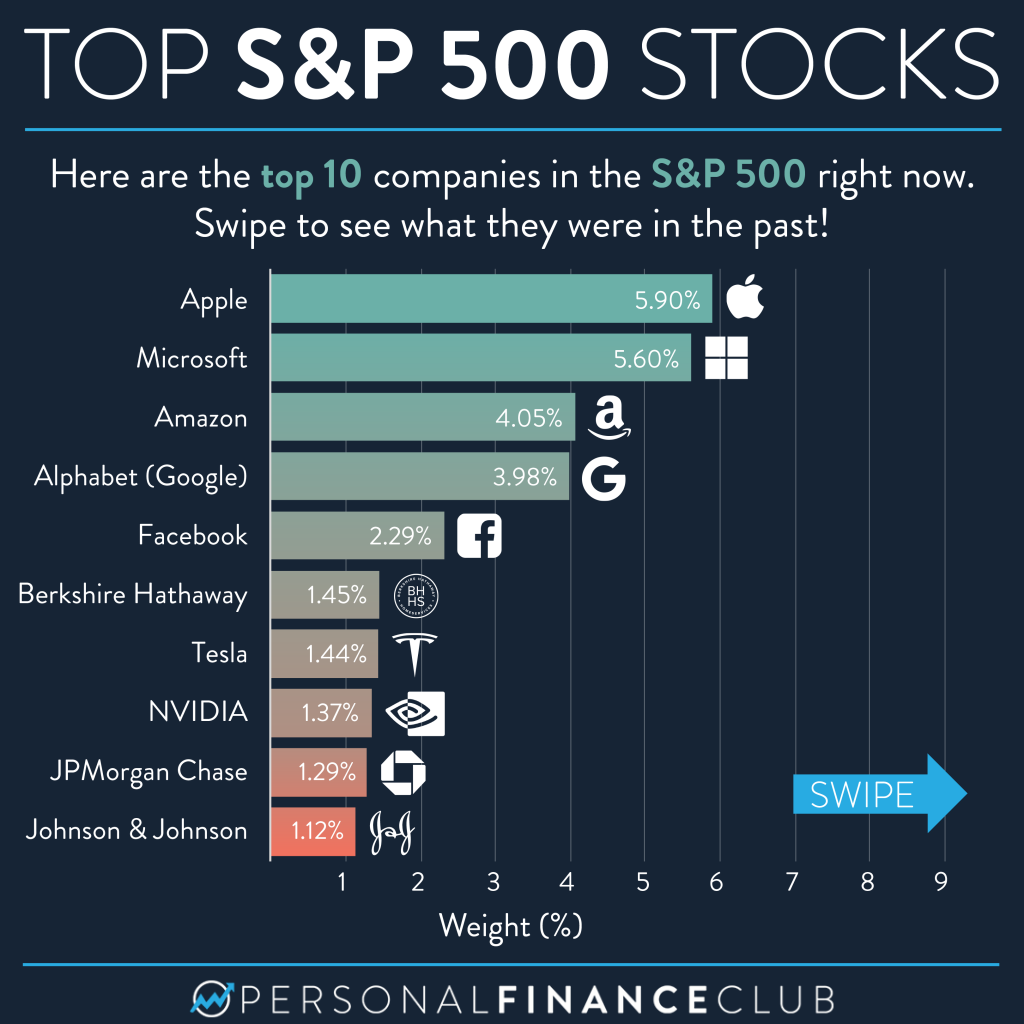

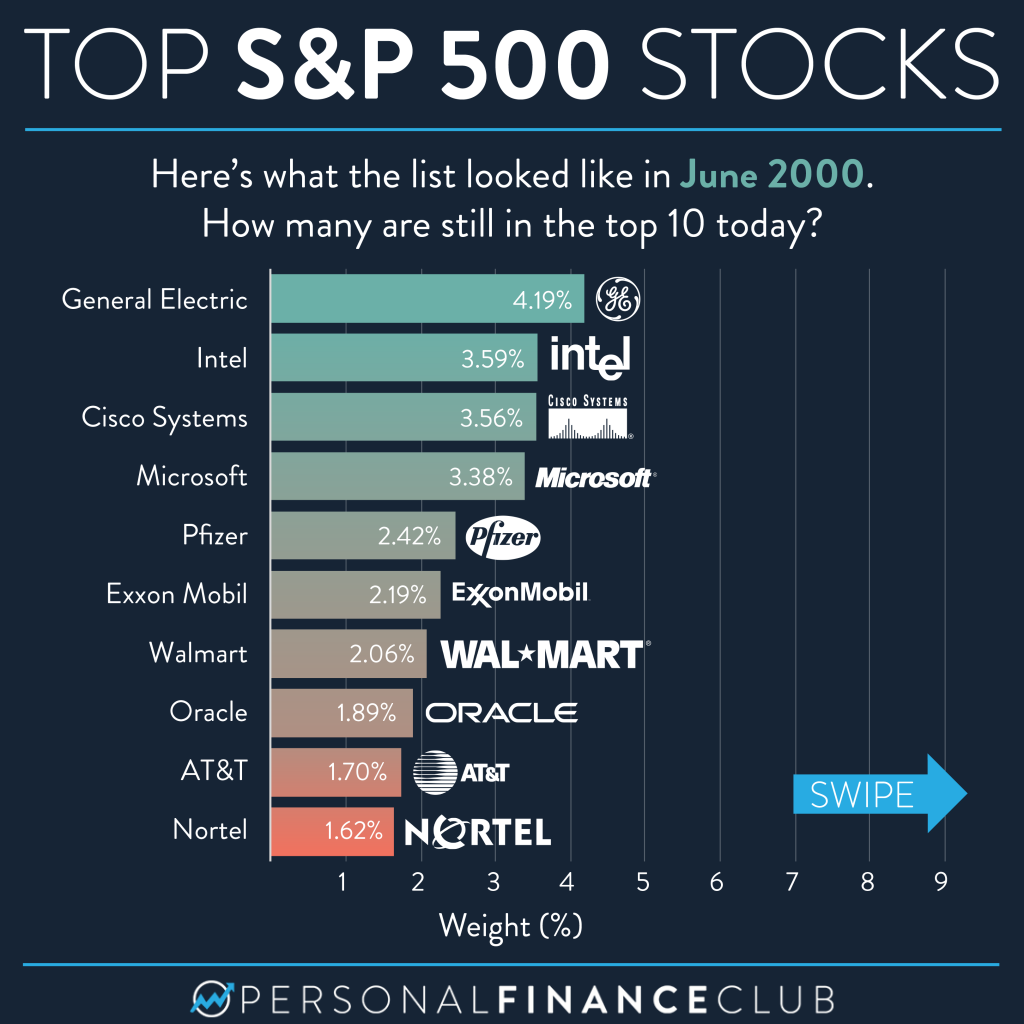

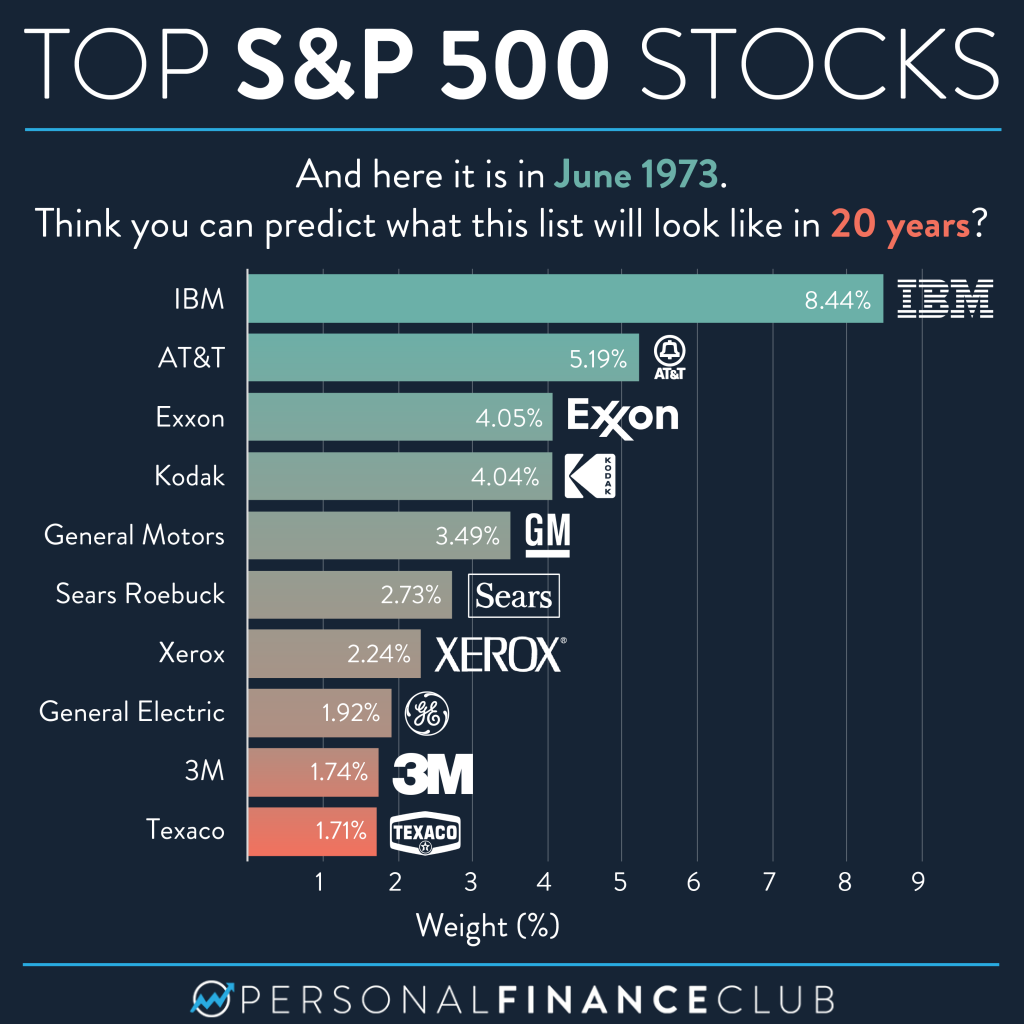

* “Tech giants have gotten too big”. All the time I hear doomsday predictions about how the tech giants have gotten too big. Doomsdayers tell me how Apple, Microsoft, Amazon, Google, and Facebook make up almost 22% of the S&P 500 alone! When those valuations come back to earth it will surely irreparably crash the market, right?! Well guess what. In 1973, IBM, AT&T, Exxon, Kodak and GM made up 25% of the market. Since then the S&P 500 has returned 16,370% (a CAGR of 11.2%). So big companies at the top doesn’t seem to mean that the sky is falling.

* “Buying Apple/Amazon/Facebook/Tesla/Whatever is a sure thing!” I hear this sentiment all the time too. Why buy the “bad” stocks when you can just by the gold standard companies that are sure things. When you look through these lists, you realize the “sure bet” of one decade may be the dying giant of the next. No stock appears on all three of these lists. In 20 years the top 10 will almost certainly look very different. I wouldn’t hitch your wagon to just one of these stars.

* The “self-cleansing” nature of index funds. If you bought an index fund in June of 1973, you would have realized that 16,370% return without doing any work of picking stocks. An index fund automatically adds the newest/smallest companies as they become big enough to be listed and drop the oldest/dying companies as they fall off the list. That means you always own the biggest and growing stocks, in proportion to their size. If the tech giants of today aren’t going to be the biggest companies of next decade, who is? Who cares! Because we own them all and we’ll benefit from the growth of every company.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

Data source: @fidelity, FMRCo, Bloomberg, Haver Analytics, FactSet.

via Instagram

All Courses on sale until Sunday 5/19!

All Courses on sale until Sunday 5/19!