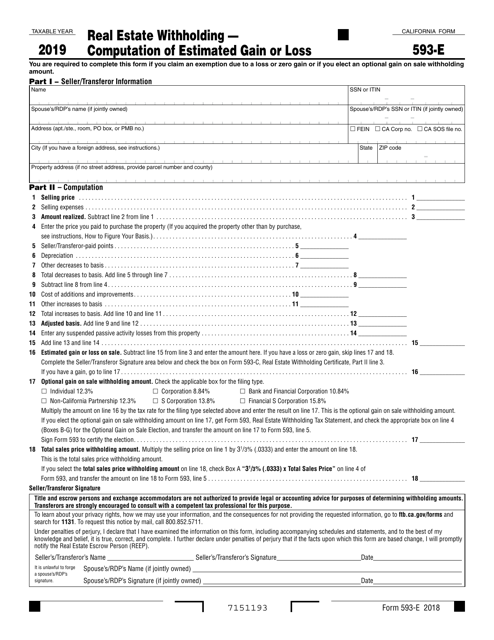

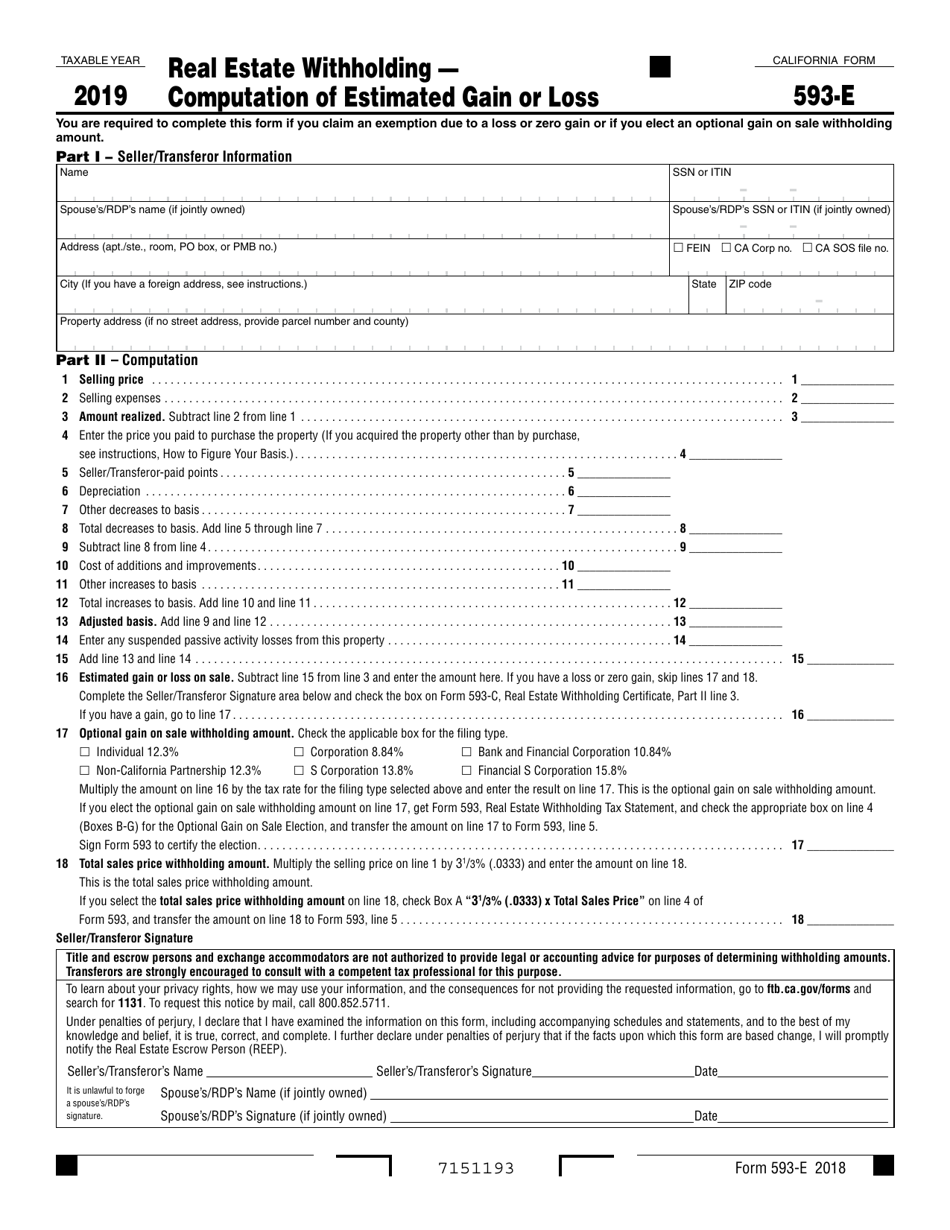

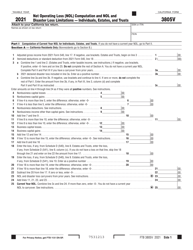

Form 593-E Real Estate Withholding - Computation of Estimated Gain or Loss - California

What Is a 593-E Form?

Form 593-E, Real Estate Withholding - Computation of Estimated Gain or Loss , is a California tax form required for all real estate sales or transfers for which you, the seller/ transferor, are claiming an exemption due to a loss or zero gain or if you elect an optional gain on sale withholding amount. The seller/transferor completes this form 593-E for sales closing within the applicable tax year. This form is signed under penalty of perjury. The seller/transferor must keep this form for five years and provide it to the Franchise Tax Board (FTB) upon request.

How to Get a 593-E Form?

California Form 593-E was released by the California Franchise Tax Board . The latest version of the form was issued in 2019 . A fillable 593-E Form is available for download through the link below.

How to Fill Out Form 593-E?

Follow these Form 593-E instructions:

- Enter the name, applicable SSN or ITIN tax identification number, and address of seller/ transferor. Enter the subject property address.

- Enter the selling price equalling the total amount you will receive for the property. Separately enter all 593-E selling expenses including commissions, advertising fees, legal fees, and loan charges paid by the seller/ transferor.

- If you purchased the property, enter the property purchase price. The purchase price includes the down payment and any debt you incurred.

- If the seller/ transferor paid points for you when you acquired the property, enter the amount paid by the seller/transferor on your behalf, unless already subtracted.

- Enter the amount of depreciation you deducted or could have deducted on your California income tax return for business or investment use of the property under the method of depreciation you chose. Separately include other amounts that decreased your basis, such as casualty and theft loss deductions and energy credits.

- Enter any additions or improvements to the property that adds to the value to the property, prolong its useful life, or adapt it to new uses. Separately also enter any other amounts paid for that increase the basis of the property including settlement fees, special assessments, or the cost of restoring damaged property.

- Enter suspended passive activity losses that directly relate to the property sold. Other losses such as net operating losses and capital loss carry-forwards cannot be used.

- Using instructions on the form, calculate the Estimated Gain or Loss on Sale. If you have a gain, this is your estimated gain on the sale of your property. If you have a zero gain or loss, check the box on the separate Form 593-C. This can only be claimed if the taxpayer has a tax identification number. You will not be subject to withholding on this sale.

- Using instructions on the form, calculate the Optional Gain on Sale Withholding Amount. If you elect to use this amount, check the appropriate box, and enter this amount on the separate Form 593.

- Using instructions on the form, calculate the Total Sales Price Withholding Amount. If you select this amount, check the appropriate box and enter this amount on the separate Form 593.

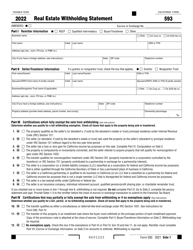

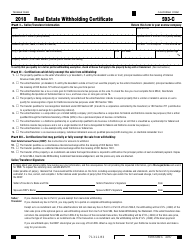

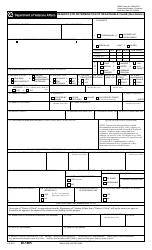

Form 593-E Related Forms:

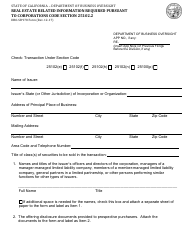

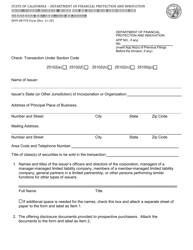

- Form 593, Real Estate Withholding Tax Statement;

- Form 593-C, Real Estate Withholding Certificate;

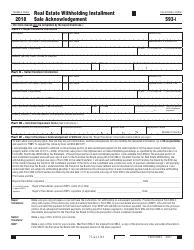

- Form 593-I, Real Estate Withholding Installment Sale Acknowledgement;

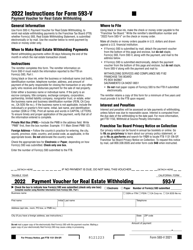

- Form 593-V, Payment Voucher for Real Estate Withholding.